Tel: (916) 226-2000 | (877) 708-0300

9290 W. STOCKTON BLVD, SUITE 104, ELK GROVE, CA 95758

OneSource Stoploss Insurance Marketing (c) 2014

Lorem ipsum dolor sit amet conse ctetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut.

ABOUT US

Why is self-funding increasing?

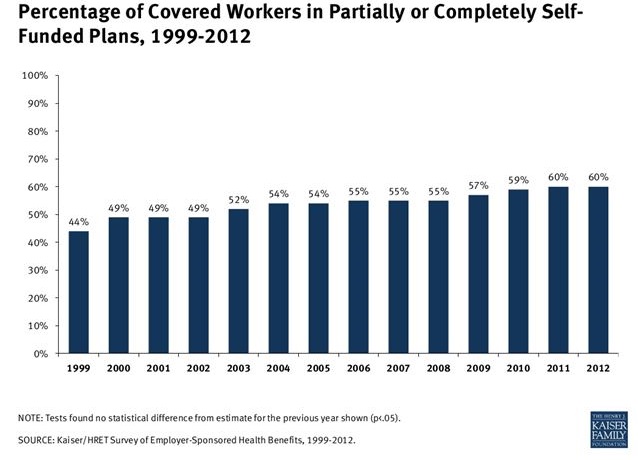

The percentage of employers self-funding their health plans has grown tremendously in recent years as the total number of employees participating in self funded plans has increased from 44% in 1999 to 60% in 2012. This momentum shift is driven by employers’ desire to have greater flexibility with plan design and cash flow. With the implementation of PPACA underway, four new fees will be assessed going forward: Patient Centered Outcomes Research Institute fee (PCORI), transitional reinsurance fee, health insurance industry tax and federal/state exchange fees. While still subject to much of the PPACA mandates, self-funding remains extremely attractive as they are exempt from paying the Health Insurance Industry Tax.

WHY SELF-FUNDED EMPLOYERS SHOULD CONSIDER STOP LOSS INSURANCE

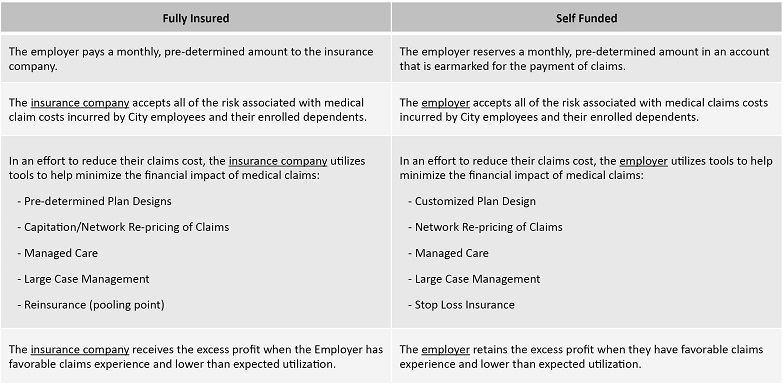

What is a self-funded plan?

A self-funded plan is one in which the employer group takes the place of the insurance company and assumes the financial risk for providing health care benefits to its employees. The group, not the carrier, is responsible for the claims costs incurred by its plan members. The employer’s plan is administered by a Third Party Administrator (TPA) or by an insurance carrier functioning in an Administrative Services Only (ASO) capacity. The employer utilizes various tools, including stop loss, to help control overall losses by improving their ability to reduce plan expenses and premiums.

Which groups should consider self-funding?

Not all employer groups are good candidates to self fund. While not the rule, here are some basic guidelines:

-Ideally, the employer group should have a steady employee population, stable claims experience and be larger in size – typically at least 100 employees.

-The employer group must be willing to practice the funding discipline necessary to both build reserves and handle the cash flow fluctuations that come with

paying their own claims.

-The employer group should be willing to commit to a minimum of a 2-3 year strategy in order to realize its full effects.

-Employer groups who have multi-state locations and desire one consolidated health plan offering.

How does Stop Loss insurance protect the employer?

The availability of competitive stop loss options is one of the most critical components in determining an employer group’s ability to self fund. Since the employer is accepting the financial responsibility for the medical claims incurred, they are typically most concerned with two potential catastrophic scenarios:

1. Individuals with catastrophic claims.

2. The group’s collective utilization of the health plan.

Stop Loss Insurance is designed to pay for catastrophic claims that exceed the employer’s pre-determined risk tolerance. Stop loss coverage is available in two different formats, both designed to mitigate the concern of potential catastrophic claim events.

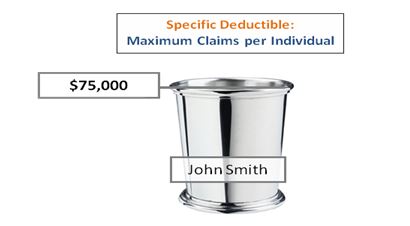

Specific Stop Loss Insurance (Individual)

Specific stop loss coverage provides protection from catastrophic losses on each individual insured under the plan.

Example: An employer group with 250 employees selects a $75,000 specific deductible. Employee John Smith has a heart attack and the total claims incurred during his hospital stay totaled $150,000. The employer is responsible for the first $75,000 in medical claims incurred by John Smith. The stop loss carrier then reimburses the employer for the $75,000 that exceeded the specific deductible.

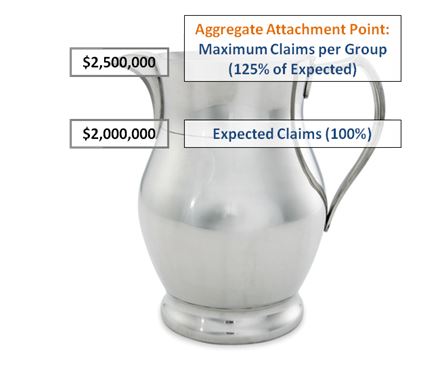

Aggregate Stop Loss Insurance (Group)

Aggregate stop loss coverage provides a second layer of protection for self funded health plans intended to limit the plan’s maximum financial exposure. The aggregate “deductible” is determined by the insurance company and is regularly set at 125% of the expected claims for the group.

Example: A stop loss carrier evaluates a company with 250 employees and develops an expected claims attachment point of $2M. They then adjust it upwards by 25% to arrive at a maximum claims attachment point of $2.5M. While the employer group is self funded, they have capped their maximum out of pocket exposure by purchasing this type of coverage. See example: